UK — Easing inflationary pressures see economic momentum improve

The UK economy is slowly gaining momentum following a shallow recession in the second half of last year. The OECD forecasts GDP growth to rise from an estimated 0.1% in 2023 to 0.4% in 2024, reflecting the waning drag from past high energy and food prices. Further acceleration to 1% is expected in 2025 as disinflation allows the Bank of England to start easing interest rates—likely from Q3 2024—supporting continued recovery in real incomes.

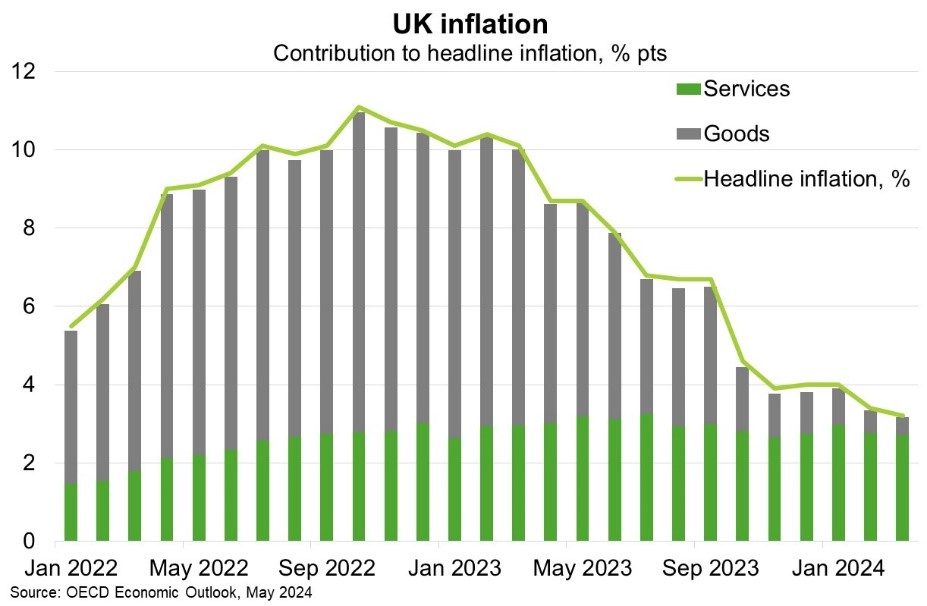

That said, the outlook is weak compared to annual average GDP growth of 2% in the five years prior to COVID-19. While annual consumer price inflation fell to 2.3% in April, from a peak of 11.1% in October 2022, price pressures in services are proving persistent (Chart). High services inflation (5.9% in April) and restrictive fiscal policies needed to stabilise high debt will continue to weigh on private consumption. Upside inflation risks stem from the UK’s tight labour market and exposure to potential further surges in energy prices if geopolitical tensions worsen. Meanwhile, soft external demand will constrain export growth while business investment will remain modest amid financial pressures, subdued demand and global uncertainty. That said, strong results in local elections this month suggest Labour will win a significant majority at the general election, scheduled for 4 July 2024. This may lessen political uncertainty (the UK has had three prime ministers and five chancellors since the last 2019 election) that has weighed on investor confidence.

The UK was Australia’s 12th largest export market in FY2023 and remains our second biggest source and destination for investment. While exports to the UK remain below pre-COVID levels, the Australia-UK Free Trade Agreement entered into force in May 2023. To the extent that UK economic momentum continues to improve, greater access to the UK market should open new export opportunities, particularly for agriculture producers.