© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

China—Fiscal stimulus underwhelms amid increasing headwinds

China announced much-anticipated additional stimulus of RMB10 trillion (US$1.4 trillion, 7.7% of GDP) this month to bolster its slowing economy. Local governments were authorised to issue additional bonds over the next five years to refinance riskier “hidden” debts and free up capital for infrastructure spending. Although this alleviates immediate local government fiscal strains and minimises the risk of defaults, markets were underwhelmed by the omission of direct and large-scale stimulus to boost domestic demand. Given the scale of China’s underlying structural challenges, reflating the economy is likely to require additional stimulus to recapitalise banks, boost consumer spending and support the depressed property market. China’s producer prices fell by 2.9% year-over-year in October, marking the 25th consecutive month of producer deflation. While retail sales rose more than expected in October, industrial production and investment data missed forecasts.

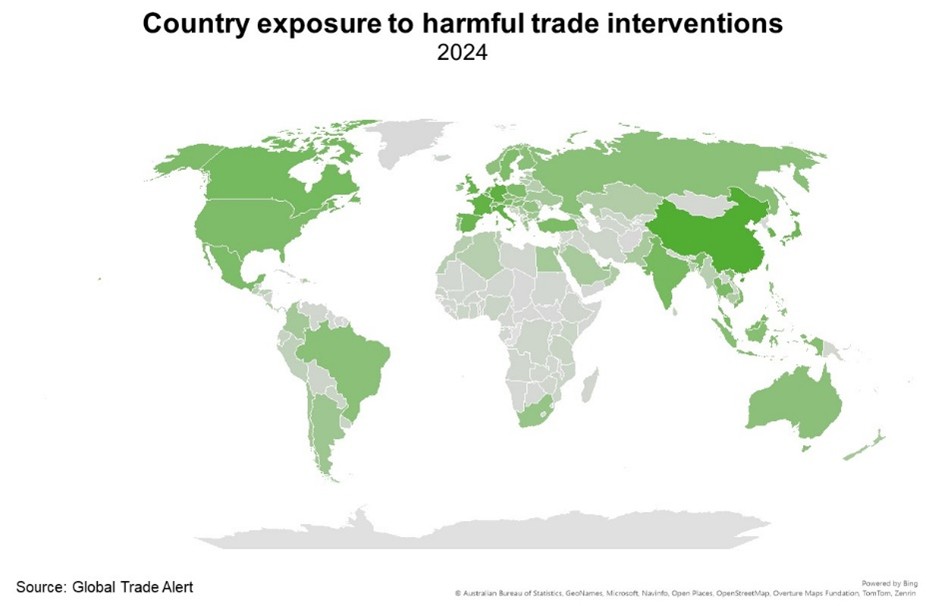

Amid weak domestic demand, China’s reliance on exports to achieve its growth target of ‘around 5%’ has intensified. China’s exports grew 12.7% year-over-year in October to a 27-month high of US$309 billion, boosting the trade surplus to US$785 billion in the first ten months of 2024, up 16% from the same period in 2023. This economic model—based on large amounts of high-tech manufacturing exports—has seen many countries raise trade barriers against China (Chart). However, China’s exporters face intensified challenges under the incoming Trump administration, which has promised bumper tariffs of 60% on Chinese imports. If implemented, these measures would exacerbate China’s structural slowdown, weighing on Australia and other Asian countries via weaker demand for commodities and other exports. However, Chinese policymakers may respond by adding further stimulus and accelerating efforts to rebalance the economy from export-led growth towards a more sustainable consumption-driven model. Increased US—China trade tensions may also prompt China to deepen trade relationships with other countries in the Asia-Pacific region.