© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

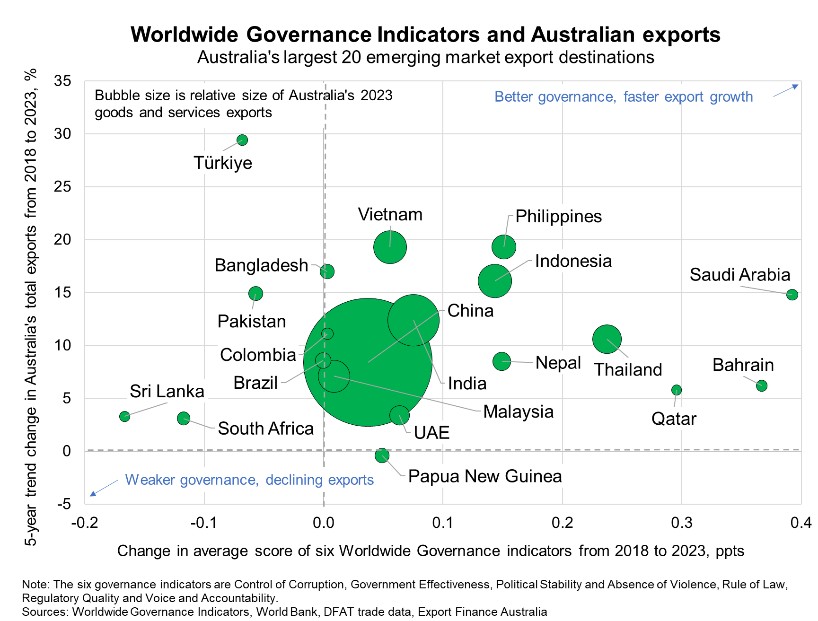

Major export markets—Governance gains support Australian exports

Governance indicators improved in most of Australia’s 20 largest emerging market export destinations between 2018 and 2023, according to new World Bank data (Chart). Governance improved strongly in the Gulf Cooperation Council (GCC)—Bahrain, Kuwait, Qatar, Oman, the United Arab Emirates and Saudi Arabia—as policymakers implement reforms to improve the business environment. Thailand, Philippines and Indonesia also witnessed gains in governance. For example, Indonesia’s Omnibus bill has helped streamline regulations, simplify licensing processes and made it easier to do business, lifting governance from a low base. Governance only slightly improved in Vietnam, as the government’s ongoing anti-corruption efforts raise domestic political turbulence and add to regulatory hurdles and burdensome approval processes for investors. Continued robust spending on infrastructure development and growing capital markets has helped lift government effectiveness in India. Improving governance, alongside robust economic activity, supported double-digit growth in Australian exports to these Asian markets over the 2018-23 period.

On the negative side, political and policy challenges amid severe economic and financial pressures in Sri Lanka and South Africa weighed on governance over the 2018-23 period. Political instability and pervasive corruption weighed on governance in Pakistan, though a new IMF program is designed to enhance the government’s capacity to implement economic reforms and ease debt distress, enhancing potential for Australian exporters. A similar trend is also seen in Bangladesh. That said, Australian exports to these markets still grew as their recoveries from the pandemic lifted demand for Australian services in particular. Governance indicators eked out gains in PNG, but Australian exports declined over that period, primarily because of foreign exchange shortages in PNG, which have subsided somewhat in 2024. Foreign exchange shortages hamper local businesses’ ability to purchase imports. On balance, improving governance and business conditions in Australia’s largest emerging export markets bodes well for continued export growth ahead.