© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

China—Worsening deflation adds to economic troubles

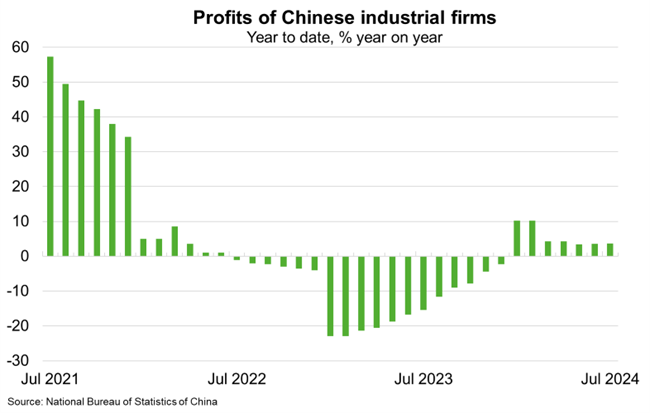

Growing concerns that deflation is becoming entrenched will challenge this year’s GDP growth target of around 5%. Core inflation, which excludes volatile food and energy prices, rose 0.3% year-on-year in August, the lowest rate since March 2021. Producer prices fell for a 23rd consecutive month—by 1.8% year-on-year in August, steeper than July’s 0.8% decline. Deflation pressures are reflected in weak consumer confidence and spending—retail sales grew 2.1% year-on-year in August, the weakest since COVID-19 lockdowns—and low import growth. The drivers include high youth unemployment (17.1% in July) and an accelerating property market slump. An inability to raise prices amid weak demand is weighing on the profits of local (Chart) and foreign-owned businesses. The American Chamber of Commerce reports that just 66% of surveyed US firms in China were profitable in 2023, a record low.

Experience from Japan suggests that deflation costs more to fix the longer it lasts. Past stimulus has helped boost manufacturing production and exports—which rose at the fastest annual pace in 17 months in August. But stimulus has also raised production of consumer goods at a time of weak demand, worsening deflation. Former People’s Bank of China governor Yi Gang suggests Beijing focus on “proactive fiscal policy” and “accommodative monetary policy” to end deflation. Morgan Stanley estimates China must spend up to CNY10 trillion (US$1.4 trillion, 7.5% of GDP) over two years to reflate the economy—equivalent to 2.5 times the size of the 2008 GFC stimulus package. But any new stimulus is likely to be modest given authorities concern about stoking financial instability.

China’s economic challenges heighten risks to Australian exports. Weak consumer demand poses headwinds for services exports while challenges in property construction are contributing to declining prices for resources exports, including iron ore, coking coal and copper.