© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

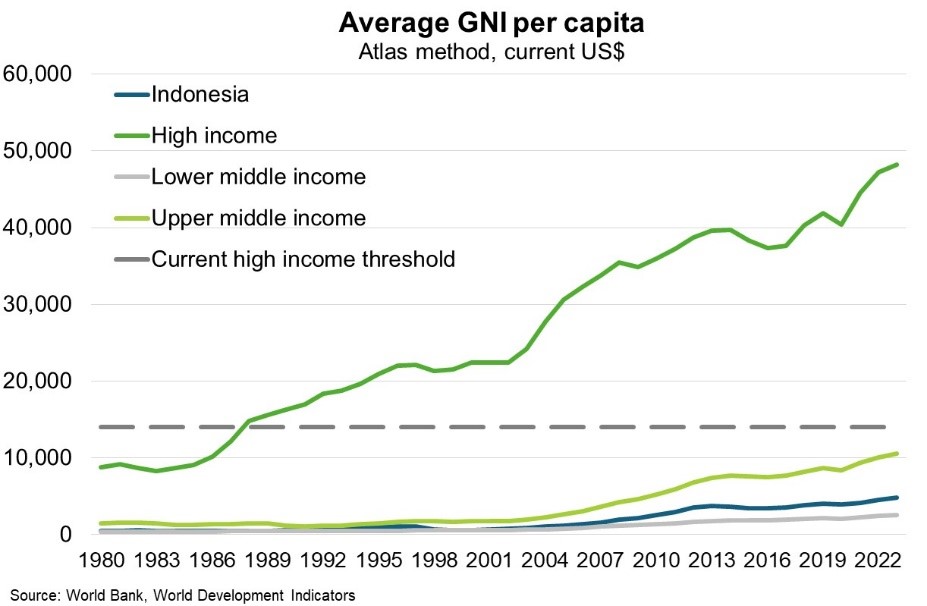

Indonesia—High-income status by 2045 will require structural reforms

Indonesia’s growth outlook remains strong despite uncertainties from tight global financial conditions, geopolitical tensions, and commodity price volatility. The IMF forecast GDP growth of 5.0% and 5.1% in 2024 and 2025 respectively, with robust domestic demand offsetting the drag from softer commodity prices. Authorities have been pursuing a growth agenda comprising higher public spending, institutional reforms, and industrial policies to enhance the value-added from raw commodities. However, Indonesia’s goal to achieve high-income status by 2045 is ambitious (Chart), requiring annual GDP growth of 5.5-6% to be sustained over two decades. This will necessitate further structural reforms to lift potential growth, which is currently estimated at around 5%. Indeed, IMF research suggests Indonesia lags in key structural areas relative to “success countries” that have transitioned into high-income status. Improving economic openness, governance, business regulation and human development are recommended priorities.

For instance, Indonesia is in the bottom quartile for World Bank governance indicators related to control of corruption, government effectiveness, political stability, regulatory quality, rule of law, and voice and accountability. This is much lower than the average of success countries at their starting point. While a smooth transition to president-elect Prabowo Subianto is expected in October, a recent stand-off between the legislature and judiciary highlights shortcomings. In late August, major protests forced parliament to shelve draft legislation that sought to override two Constitutional Court rulings linked to upcoming regional elections. The legislation was seen to strengthen the political influence of outgoing President Joko Widodo fuelling public anger at his perceived dynastic ambitions.

Facilitated by improved market access, Australian exports to Indonesia have grown 80% over the past five years to $15 billion, making Southeast Asia’s largest economy our ninth largest export market. Successful implementation of structural reforms—including strengthening anti-corruption frameworks and improving the legal system to support business certainty—would further improve export opportunities.