© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

ASEAN—Robust economic growth susceptible to external shocks

The ASEAN-5 are expected to continue to outperform, supported by firm domestic demand and export growth. The IMF forecasts the ASEAN-5 (Indonesia, Malaysia, the Philippines, Singapore and Thailand) to expand 4.6% in 2025, well above growth forecasts for the world (3.3%) and emerging markets (4.2%).

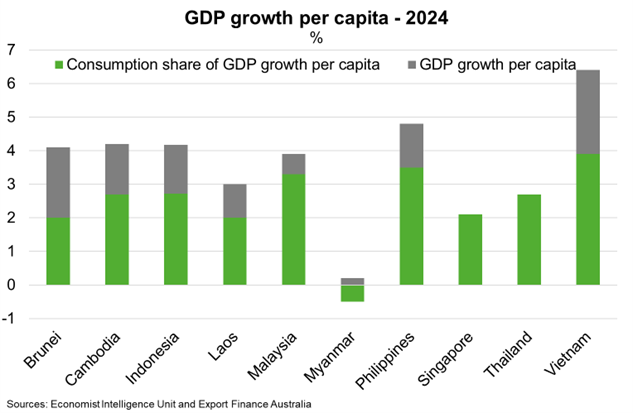

A range of factors support the export outlook including robust demand for manufactured goods and a recovering tourism sector, shifts in global supply chains, and relatively strong productivity growth. Indeed, the Economist Intelligence Unit forecasts total factor productivity to grow 3.9% in Indonesia and 3.0% in Philippines (compared to 2.5% in China and 0.7% in Japan) in 2025. Domestic demand will also remain a growth driver (Chart), particularly given moderating inflation (1.9% year-on-year Q4 2024) and monetary easing. Longer term growth and resilience will be bolstered by growing connectivity and intra-regional trade, which accounted for 22% of global trade volumes in 2022 (despite trade with the US and China doubling between 2017 and 2022). These trends are likely to see the region (12% of Australian exports in FY2024) remain attractive to Australian businesses.

However, ASEAN remains susceptible to external shocks—including global protectionist policies, tighter financial conditions, commodity price spikes and severe weather events—reflecting the relative size and openness of these economies. In particular, higher tariffs will dampen the regional growth outlook, with magnitudes depending on the policy responses from affected economies. Pressure on ASEAN currencies against the US dollar could also limit the ability of ASEAN central banks to ease monetary policy and worsen fiscal and financial risks. That said, comfortable foreign exchange reserves provide a buffer to excessive volatility. Domestic challenges include a lack of formal employment and widening inequality, which for instance, saw Indonesia’s middle class shrink to 48 million in 2024, from 60 million in 2018.