© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

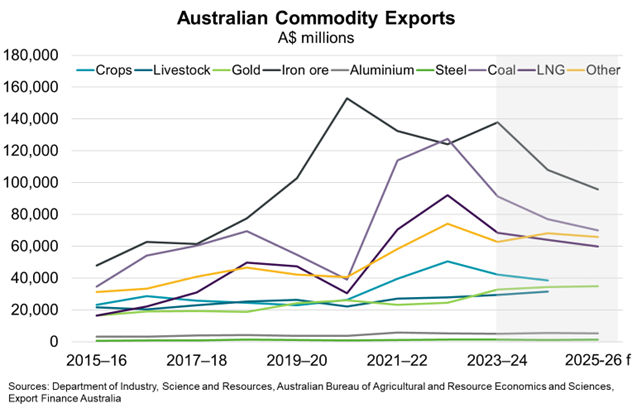

Australia—Falling commodity exports and increasing volatility

Australia’s agricultural exports are forecast to fall by $1.3 billion to $70.1 billion in FY2025, still the third highest result on record. Crop exports are forecast to fall 8% to $38.7 billion, reflecting lower exportable supply and prices. Though variation is expected with prices for wheat, barley, sorghum, sugarcane and cotton easing, while prices for canola, pulses, horticulture and wine grapes rise. Meanwhile, livestock exports are forecast to rise 7% to $29.4 billion, reflecting both higher prices and volumes. This reflects increased demand for Australian red meat in the US, China, Japan and the Middle East.

Similarly, Australian resource and energy exports are forecast to decline 10% to $372 billion in FY2025. While commodity export volumes are forecast to improve, prices are generally expected to settle at lower levels due to relatively soft global economic growth (and concentration of that growth in the services sector). That said, bauxite supply concerns have seen alumina prices surge and global uncertainty has seen the gold price reach a new high. Gold is expected to become Australia’s fourth largest export by value behind iron ore, LNG and metallurgical coal in FY2026.

Global uncertainty overlays volatility and risks to forecasts. A slower-than-expected global disinflation path, extended contraction in China’s property sector, increase in protectionist policies or wind back of energy transition measures under the Trump administration could see commodity exports underperform. So too could an easing of sanctions on Russia which alleviates pressure on global oil and gas supplies, alongside wheat, barley, aluminium, coal and steel. However, geopolitical developments could also increase prices of some commodities. For instance, escalating conflict in the Middle East could raise energy prices, while China’s export controls targeting critical minerals could reverse the recent decline in domestic critical minerals exploration expenditure.