© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Europe—Weak economic outlook and increasing risks

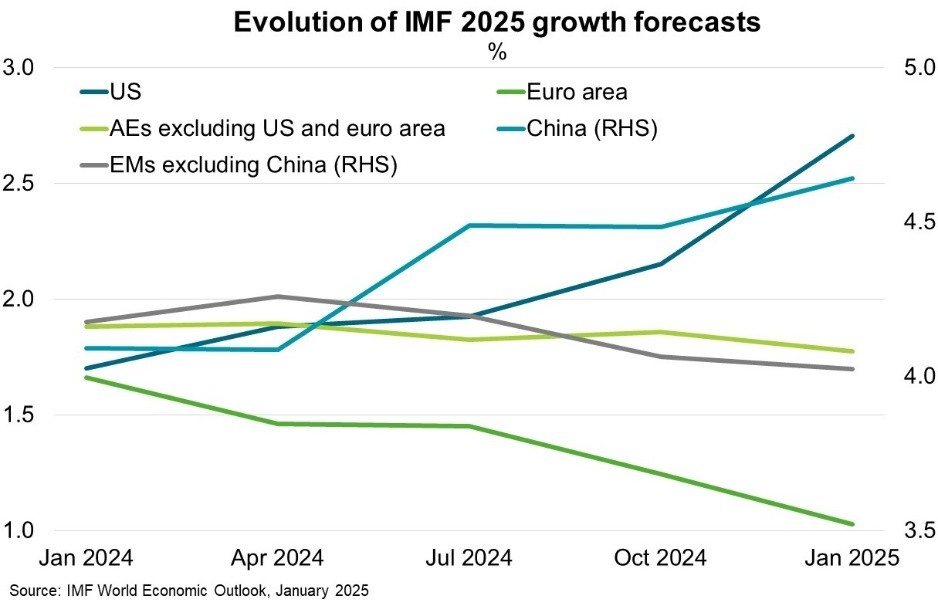

Euro area economic activity stagnated in Q4 2024, according to Eurostat’s preliminary estimate, and is set to remain weak in the near term. Surveys suggest that manufacturing continues to contract while consumer confidence remains fragile with rising real incomes yet to significantly lift household spending. Indeed, the IMF has consistently downgraded its expectations and now forecasts euro area real GDP growth to increase only modestly, to 1.0% in 2025 (Chart). Meanwhile, euro area inflation edged up to 2.5% year-on-year in January, above the European Central Bank’s (ECB’s) 2% target. Excluding energy and unprocessed food, core inflation was unchanged at 2.7% year-on-year for a fifth month. The ECB still cut interest rates to 2.75% in January, the fifth reduction since June 2024, with large fiscal stimulus unlikely given the constraints of EU fiscal rules.

Germany, the traditional economic powerhouse and largest economy in Europe, continues to lag. Manufacturing exports—once a pillar of economic strength—are weak amid declining productivity growth, unprecedented policy uncertainty, and persistent high energy prices. The energy price shock caused by Russia’s invasion of Ukraine eroded the competitiveness of Germany’s energy-intensive industries relative to the US and China. European gas prices remain about five times as high as in the US, versus twice as high before the pandemic. Higher US tariffs may soon exacerbate low growth and stubborn inflation, with Germany among the most exposed. Indeed, the Federation of German Industries expects German GDP to contract for a third straight year in 2025—unprecedented in post-war history—with US tariffs potentially deepening the expected contraction from 0.1% to 0.5%. Australia’s exports to the European Union fell 10% to $25 billion in FY2024, with weak economic performance relative to other advanced economies likely to continue to weigh on export prospects.