© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

India—Budget to boost consumption amid slower economic growth

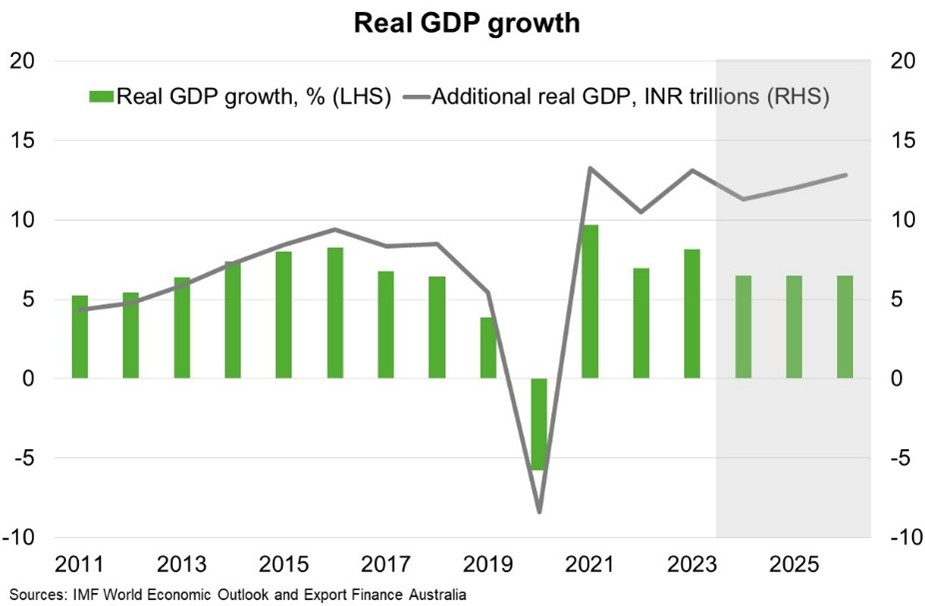

Economic growth slowed more sharply than expected in recent quarters due to weak industrial output, government spending and private consumption. GDP expanded by 5.4% year on year in Q3 2024, the smallest annual increase in seven quarters.

In response, India’s 2025 Budget presented this month aims to stimulate household consumption and improve the business climate. Notably, import tariffs on a range of intermediate and final goods were cut and a High-Level Committee for Regulatory Reforms was announced to review all non-financial sector regulations, certifications, licenses and permissions. Timely implementation of recommendations would reduce the cost of doing business, improve attractiveness to domestic and foreign investment, and improve India’s share of global manufacturing from just 2.8%. The Budget also announced significant above-inflation increases to income tax brackets, expected to provide a INR1 trillion (0.3% of GDP) boost to household incomes. According to the Institute of International Finance, multiplier effects will boost GDP by 0.4-0.5% given the high marginal propensity of lower income households to consume. Monetary easing will further stimulate domestic demand; the Reserve Bank of India cut interest rates for the first time in nearly five years this month, by 25 basis points to 6.25%, after annual consumer price inflation fell to a four-month low of 5.2% in December.

India’s growth slowdown is unlikely to be structural given improved bank and corporate balance sheets over recent years. Indeed, the IMF forecasts GDP growth of 6.5% this year (Chart), the slowest rate in four years, but still among the fastest-growing major economies globally. While risks derive from geopolitical and trade tensions, policy implementation, and adverse weather, the economy will remain supported by higher agriculture output, continued resilience of the services sector and labour market, and lower-than-expected oil prices.