© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

World—Policy uncertainty to define the 2025 economic outlook

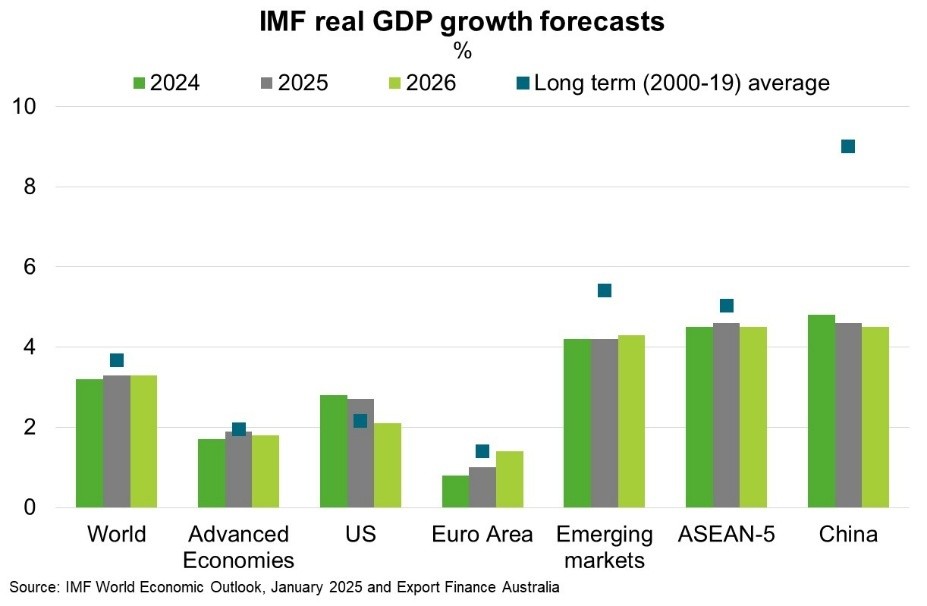

The global economy remains resilient, albeit lacklustre. January IMF forecasts suggest global growth will remain steady at 3.3% this year and next, below the historical (2000–19) average of 3.7% (Chart). But while the global outlook is broadly unchanged, divergences across countries are widening. Among advanced economies, the US is stronger than previously projected, with GDP growth of 2.7% now expected in 2025, driven by robust productivity growth and consumption. Meanwhile, growth in the euro area is expected to increase only modestly, to 1.0% this year, amid weak manufacturing exports, persistent high energy prices and low consumer confidence. Australia’s largest regional export markets will remain the world’s growth engine; with China and ASEAN both forecast to expand by 4.6% and India by 6.5% this year.

Uncertainty is high amid geopolitical conflicts, extreme weather events, societal and political polarisation, and technological advancements. Economic policy uncertainty has also spiked, especially on the trade and fiscal fronts, with many governments newly elected in 2024. Intensified protectionist policies could lower investment, reduce market efficiency, and disrupt supply chains. Policy-induced disruptions to the ongoing disinflation process could interrupt monetary easing, with implications for the sustainability of public finances and stability of financial markets. Emerging markets are particularly exposed, given their reliance on external financing and export-driven growth. The Global Risks Perception Survey confirms an increasingly pessimistic outlook. Most respondents (52%) anticipate some instability and a moderate risk of global catastrophes over the next two years, while 36% expect even more turbulent conditions. State-based armed conflict is the risk most expected to cause global crisis this year, followed by extreme weather events and geoeconomic confrontation (as sanctions, tariffs and investment screening become more common). Vigilance and diversification will remain important for Australian exporters.