© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Australia—Robust tourism supports continued services export growth

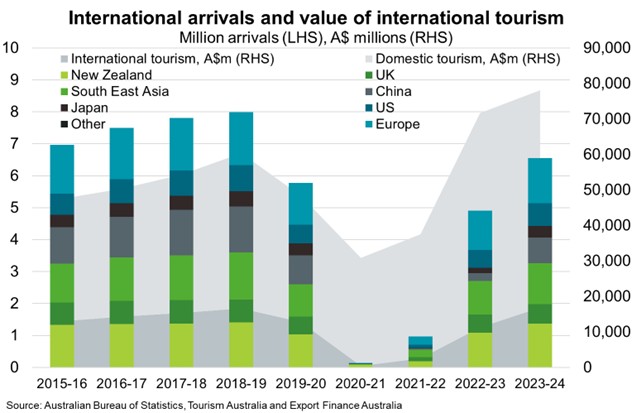

Australian services exports continued to perform well in Q4 2024, increasing by 4.6% or $1.4 billion, to $33.4 billion for the quarter, with travel contributing 29% of the increase. Growth in the value of inbound international tourism was robust, driven by higher spending as holidaymakers spent more and stayed longer. However, the figure hides a lacklustre recovery in international visitor arrivals, which remain 12% below pre-pandemic levels (Chart).

Globally, international tourism recovered close to pre-pandemic levels in 2024 with 1.4 billion overnight visits, but the recovery has been uneven. Patterns of travel appear to have changed structurally since the pandemic with stronger growth in domestic and within-region tourism. Airline capacity recovery is also uneven, with Europe and Latin America exceeding 2019 levels, but Asia (-23%), North America (-15%) and the Middle East (-24%) lagging. Australia’s international tourist source markets are also showing different patterns of recovery—arrivals from Korea, New Zealand, US, Southeast Asia, UK and Europe all exceed 85% of pre-pandemic levels, but arrivals from China remain below 60% of 2019-20 levels.

The outlook globally is positive, with UN Tourism expecting 3-5% growth in 2025 as traveller confidence returns and flight capacity increases. About 64% of the UN Tourism Panel of Experts indicate ‘better’ or ‘much better’ prospects for 2025 compared to 2024. However, global economic and geopolitical turbulence pose significant risks to the outlook. A strong US currency will support growth in US tourist spend and arrival numbers, but sluggish growth and renewed support for domestic tourism in China will further dampen recovery in Chinese tourist arrivals. China may also attract a larger share of the international tourism market if moves to increase visa-free entry arrangements translate into cost competitiveness and ease of travel.