© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Australia—US tariffs take effect, diversified exports insulate economy

US trade policy is changing rapidly, driving global economic uncertainty and subduing growth forecasts. The OECD downgraded its global growth forecast to 3.1% in 2025 and 3.0% in 2026 this month, highlighting higher trade barriers across economies and increased policy uncertainty as key drivers. Inflation is predicted to be stickier than previously expected. The direct impact of sector tariffs on Australia is limited in comparison to indirect effects of growing tariffs between countries, the economic performance of our largest trading partners—particularly China—and disruptions to international trade.

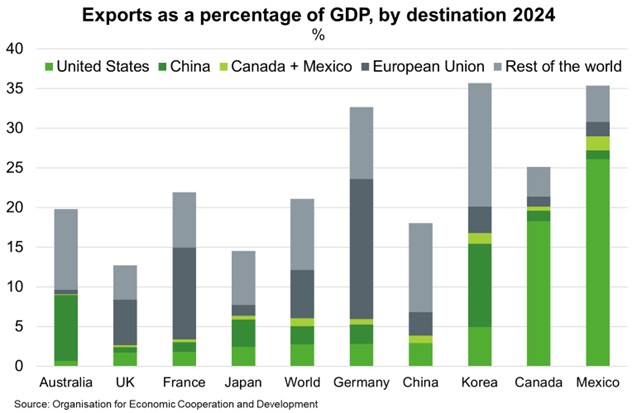

Australia’s diversified export profile ensures our GDP is relatively less dependent on US exports (Chart). 25% tariffs on aluminium and steel are the only new measures that currently apply to Australia. However, Australian steel and aluminium exports to the US represented less than 0.2% of the total value of Australian exports in 2024. There is uncertainty around what will happen on 2 April. However, President Trump has indicated that ‘reciprocal tariffs’ could be introduced on agricultural products, pharmaceutical products, cars and auto parts. US trade partners are considering their responses. Canada and China have in turn imposed tariffs of their own on a range of US goods, while responses from Mexico and the European Union have paused for now. We expect the impacts of a trade war would be broader than individual tariffs.

Short term impacts of sector tariffs on Australian exporters could depend on a range of considerations.

- Whether the tariff is applied equally across trading partners: If all imports to the US are treated equally, Australian exporters will be affected to a lesser extent than targeted measures.

- Significance of US production: Products imported to the US are disadvantaged against tariff-free local products. Where US production is small, a larger share of the tariff may be passed on to US consumers without losing market share.

- Speed of increased US supply: Particularly in the short run as US producers take time to respond to new domestic market conditions.