© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

China—Growth steady ‘around 5%’ despite rising external pressures

China set a real GDP growth target of ‘around 5%’ for 2025, for a third consecutive year. This target is relatively ambitious given a current reliance on exports to drive growth and mounting trade barriers. However, additional stimulus measures and incremental structural reforms were announced to offset persistent low consumption and deflationary pressures. The OECD upgraded its growth projection marginally to 4.8% for 2025 following the announcement of stimulus, but growth is expected to slow to 4.4% in 2026.

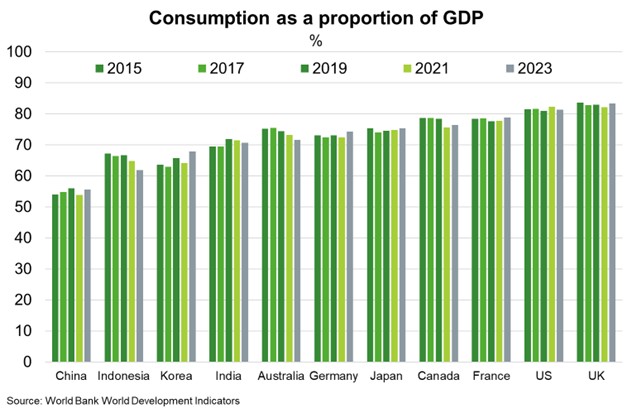

The stimulus comes with a record high fiscal deficit target at 4% of GDP and measures to improve consumption. China has one of the highest national savings rates in the world, but efforts to build the social protection system could reduce inequality and slowly shift entrenched preferences for savings over consumption (Chart). Steps toward subsidised childcare, free preschool, improved parental leave, cash for work schemes, pension reform and enabling the ‘silver economy’ are designed to build consumer confidence and spending. China’s tech sector will continue to grow with stimulus funding allocated to support development of frontier technologies (AI, quantum computing, 6G), new applications of existing technology (robotics, digitalisation), and collaboration between researchers and industry. Durable goods will benefit from expansion of ‘trade-in’ subsidies that encourage households to replace old appliances and cars with newer ones.

Downside risks remain prominent. The target was set in the context of a more uncertain external environment, with additional US tariffs on Chinese imports introduced this year, amounting to 20% on 4 March. Trade measures will compound headwinds already facing the Chinese economy, which affects Chinese demand for Australian commodities used in manufacturing and construction. However, Chinese retaliatory measures against the US, currently concentrated in the agricultural, critical minerals, resources and energy sectors, may possibly present some opportunities for Australian exporters.