© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

US—Economic exceptionalism to continue, but risks mount

The US economy began the year with strong momentum and healthy private sector balance sheets. Markets were initially positive about the Trump administration’s pro-growth economic policies, including deregulation, tax cuts, and a public sector efficiency drive. However, higher US tariffs and a wave of retaliatory measures from major trading partners, alongside economic policy uncertainty, are weighing on the outlook for the world’s largest economy and Australia’s fifth largest export market. Indeed, the OECD recently downgraded its US GDP growth forecast to (a still strong) 2.2% in 2025 and 1.6% in 2026, from 2.8% in 2024.

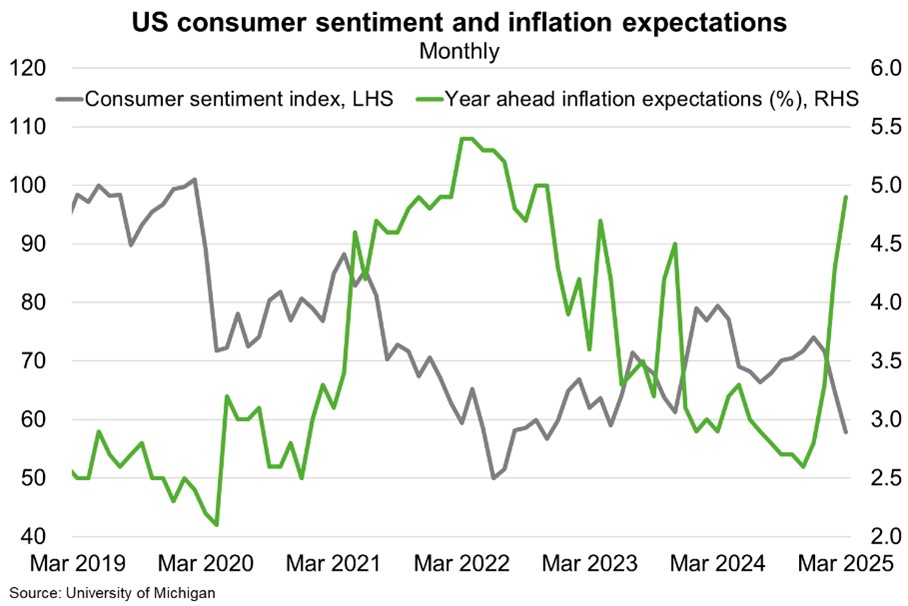

President Trump declining to rule out a recession this year saw the S&P 500 fall more than 10% below the record set on 19 February, tipping the threshold for a market ‘correction’. Meanwhile, consumer confidence dipped for a third consecutive month in March to be down 22% from December 2024, according to preliminary survey data published by the University of Michigan (Chart). Amid a resurgence of tariffs, year-ahead inflation expectations jumped to 4.9% this month, even as the outlook for household income and jobs fell. To the extent that consumers fear higher prices, the US Federal Reserve will adopt a more cautious approach to monetary easing even if the economy slows. Lower equity market valuations (which account for 25% of total household assets), deteriorating consumer confidence and higher for longer interest rates would weigh heavily on private consumption. In turn, this will negatively impact economic growth, given personal consumption accounts for nearly 70% of US economic activity.

Additional risks to corporate earnings and business investment arise from the significant revenue US corporates derive from overseas markets subject to recent new trade restrictions. With public finances increasingly strained, that leaves the US economy with fewer shock absorbers amid intensifying risks. Partly offsetting this, is that the lure of tariff-free access to the US market may encourage some direct investment from firms onshoring production facilities.