© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Vietnam—Economic outperformance at risk from trade disruptions

Despite the setback caused by the strongest typhoon to hit in several decades, Vietnam’s economy rebounded strongly by 7% in 2024, driven by the resilient export-oriented manufacturing sector and high foreign direct investment. Vietnam’s regional outperformance is expected to continue; in January the World Bank forecast real GDP to expand 6.6% in 2025 and 6.3% in 2026.

While there are reasons for optimism—including for infrastructure development with a focus on energy—the outlook is subject to shifting global trade dynamics and targeted US trade remedies. Vietnam is among the most trade exposed emerging markets due to the following.

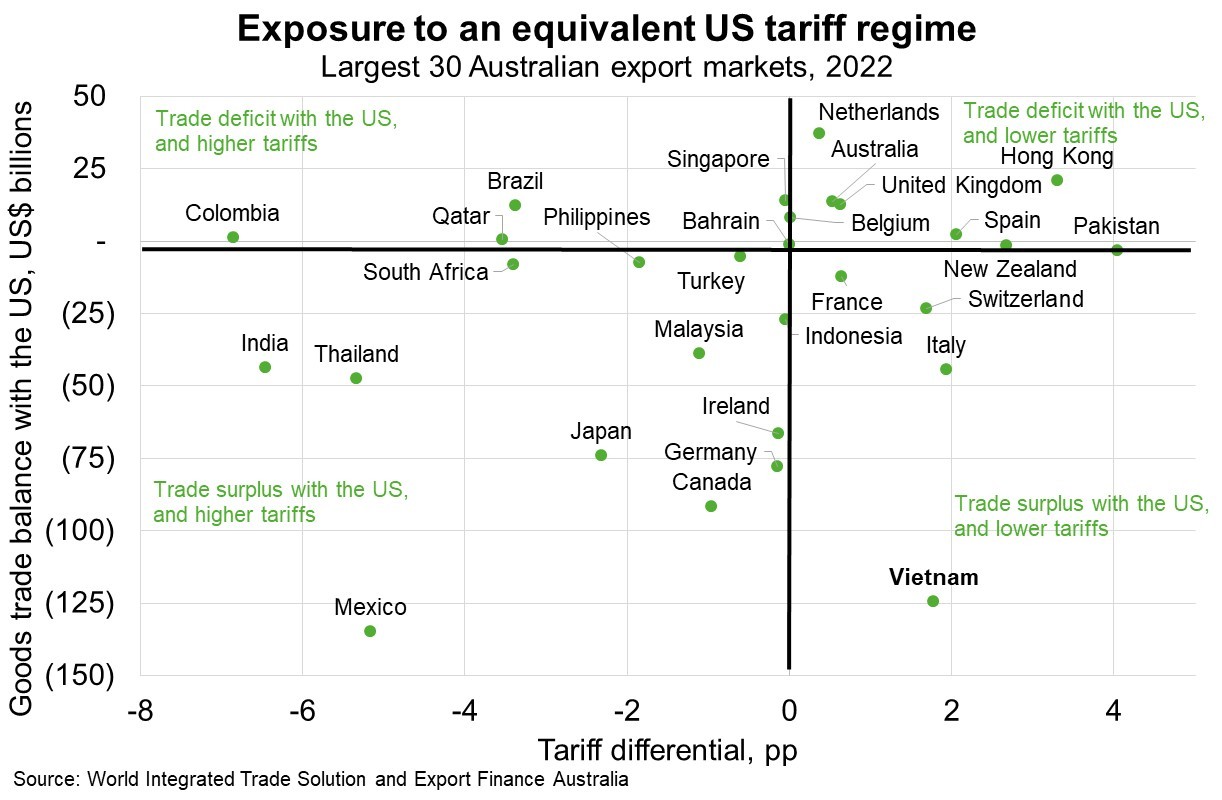

- Substantial trade imbalances. Vietnam has the third largest trade surplus with the US—meaning the value of exports exceeds the value of imports—behind China and Mexico. Given President Trump’s focus on eliminating such trade surpluses, Vietnam has vowed to increase imports of US aircraft, LNG, agricultural and other products. However, US-China trade tensions since the first Trump presidency have seen businesses shift production from China to Vietnam to spread supply chain risks and circumvent tariffs. This has propelled the trade surplus with the US to US$122 billion in 2024, a 19% increase from the previous year.

- A heavy reliance on US demand. Total Vietnamese exports to the US were US$138 billion in 2024, accounting for almost 30% of Vietnam’s GDP. While Vietnam’s exports of steel and aluminium to the US, now subject to a 25% global tariff (on top of previous tariffs), constitute a relatively small share, further sectoral tariffs that have been flagged by the US administration, for instance on agriculture or semi-conductors, would be more impactful.

That said, Vietnam may be somewhat insulated from reciprocal tariffs that would adjust US tariff rates to match those imposed by trading partners. Unlike India, Thailand, and Malaysia, Vietnam imposes lower average tariffs on US imports than Vietnamese exporters face in the US market (Chart).