© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

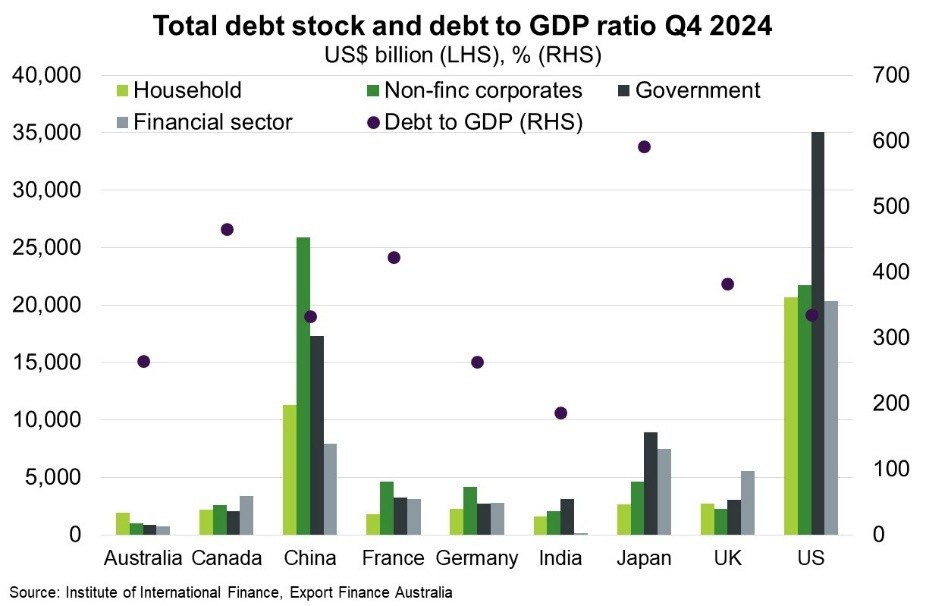

World—High global debt could strain economic resilience

Global debt rose by US$7 trillion to reach a record US$318 trillion in 2024. The global debt to GDP ratio increased for the first time in four years, by 1.5 percentage points to 328%. The US and China continue to overshadow the rest of the world (Chart). Growing global debt, and the cost of servicing it, increases vulnerability to economic shocks.

Global debt is expected to remain high, but with a slowing rate of accumulation. Private sector borrowers will remain cautious with high economic uncertainty and elevated borrowing costs. However, government debt accumulation will remain elevated amid a growing appetite for expansionary fiscal policies and larger military spending. For example, Germany’s Bundestag passed a large spending package this month which lifts the “debt brake”—a strict legal limit on government borrowing—that is increasingly seen as a factor weighing on economic performance. While efforts are underway in the US to reduce government spending, debt servicing costs (which exceeded defence spending for the first time in 2024) will pressure the debt stock in the near term. Indeed, the composition of global debt has slowly shifted towards government, which accounted for 30% of total debt at the end of 2024, up from 27% in 2015. Market reactions to rising US government debt have been muted given the country’s economic outperformance, productivity growth, and the safe haven status of the US dollar. However, market reactions to fiscal largess in other countries may be more disruptive.

Emerging economies, which must roll over a record US$8.2 trillion in debt this year, face additional pressures from high servicing costs, cuts to foreign aid and exposure to trade policy shocks—potentially triggering liquidity challenges and curbing the ability to access foreign currency debt.