Australia—Container shipping delays and costs frustrate export outlook

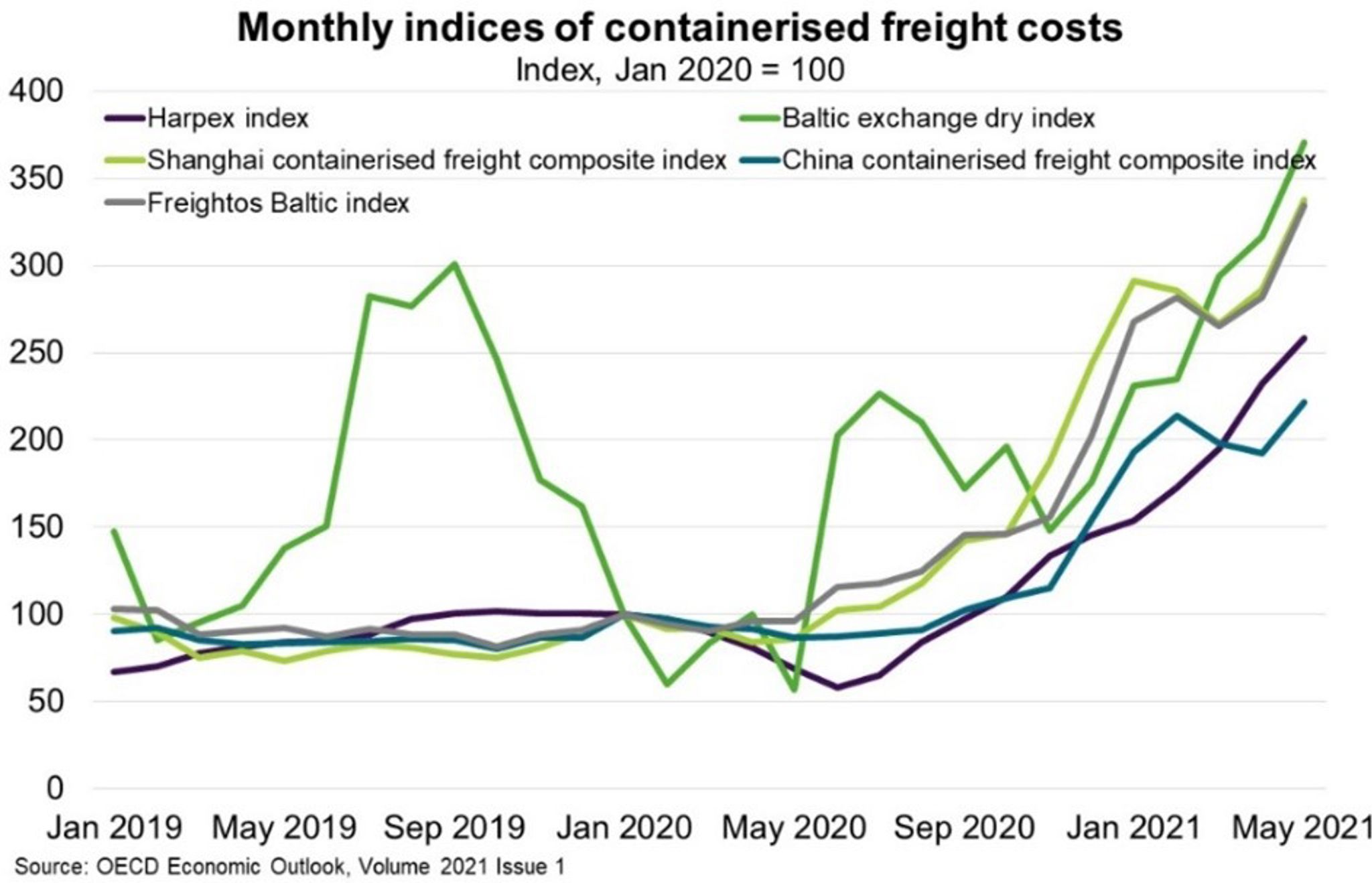

The global economy is highly dependent on maritime transport—over 80% of global merchandise trade volumes are carried by sea. Most of this trade is commodities, such as iron ore, being transported in bulk carriers. However, global container shipping costs have soared in recent months (Chart) amid strong demand for consumer durables and supply bottlenecks in ports that have led to substantial delays.

An unanticipated surge in demand for manufactured goods from Asia is the product of pent-up demand following lockdowns in the front half of 2020 and shifting consumption patterns from services to goods. On the supply side, border restrictions, distancing rules and quarantine standards have weakened productivity and prolonged port processing times. This has hampered the return of scarce containers to Asia and generated ripple effects along the entire shipping chain. The six-day blockage of the Suez Canal, which delayed around US$9 billion worth of trade per day, added to port disruptions. While the OECD expects this atypical congestion to persist for a few more months, a recent COVID-19 outbreak in one of China’s busiest container ports highlights the ongoing risk of disruptions to international trade.

Australia’s geography means exports are highly dependent on shipping for access to supply chains and final markets. The Australian Chamber of Commerce and Industry National Trade Survey found that perceptions of shipping services among Australian businesses have fallen amid rising costs and delays. Surveyed firms also maintained a lingering resentment over union strikes by port workers, which added to stressed supply chains. Indeed, the World Bank’s Container Port Performance Index ranked two of Australia’s three largest container ports in the bottom 15% of 351 ports worldwide. While the supply of global shipping capacity will eventually catch up to demand, prices are not expected to normalise this year. Poor port performance compounds the cost to Australian exporters in the meantime.