Australia—Record resources and energy exports drive investment

Russia’s invasion of Ukraine has resulted in a significant recalibration of the global resources and energy sector. In the March quarter 2022, the Office of the Chief Economist’s Resources and Energy Export Values Index at the Department of Industry, Science, Energy and Resources rose 49% from the March quarter 2021; a 6% rise in volumes added to a 42% gain in prices. As a result, Australia’s resource and energy export earnings are forecast to lift by 33% to a new record $425 billion in 2021-22, before falling back to $370 billion in 2022-23, when bulk commodity prices are likely to decline from their current levels. However, strong commodity prices overall, increased demand for inputs to clean energy supply chains, and the reorganisation of commodity supply chains as countries seek to substitute away from Russian supply could yet buoy increased activity in Australia’s resources sector.

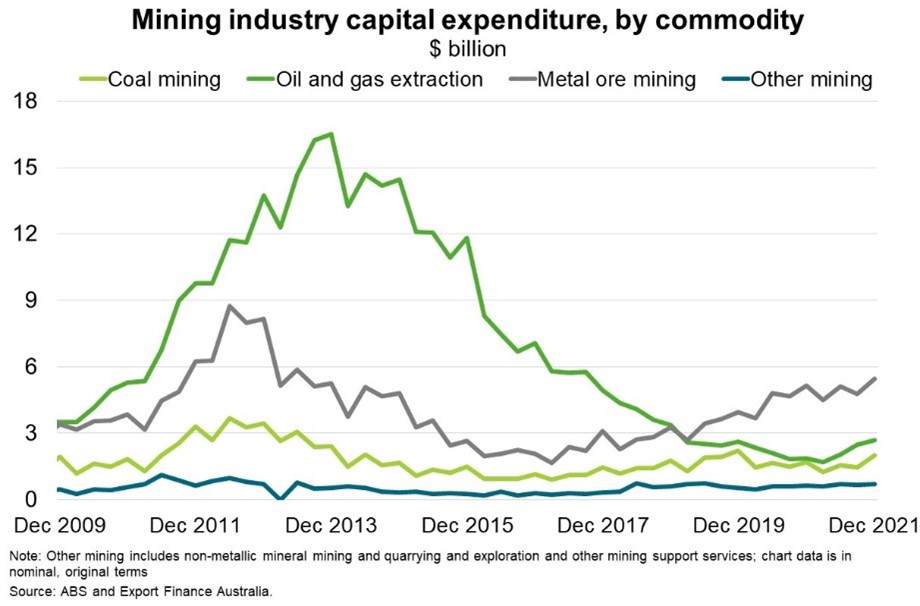

Mining investment has fallen sharply from a peak of 9% of GDP during the commodities ‘super cycle’ in 2013. However, Australia’s mining industry invested $10.9 billion in the December quarter of 2021, up 16% from a year earlier (Chart). Meanwhile, exploration spending was steady at $1 billion in the December quarter, representing a sustained lift from the recent low of $683 million in the June quarter 2020. Despite the ongoing energy transition weighing on coal investments and geopolitical tensions between Australia and China potentially limiting Chinese direct investment, shifting of the export profile to net zero emissions will support long term investment opportunities and resilient supply chains.