United States—Soaring inflation raises economic and financial risks

US economic growth is expected to underperform its historical trend this year and next, and risks of a recession are rising amid soaring inflation and rapid monetary policy tightening. The consumer price index spiked to an annual pace of 9.1% in June, a 41-year high. Outside of energy prices, inflation pressures are broadening, cementing expectations the Federal Reserve will hike interest rates by at least 75 basis points tomorrow. Last month the Federal Reserve forecast interest rates would rise by 325 basis points this year and next, but that assumed a moderation in inflation that has not yet transpired. Even more aggressive monetary tightening could be necessary, particularly if inflation expectations are dislodged; potentially destabilising financial markets and undermining household consumption and business investment.

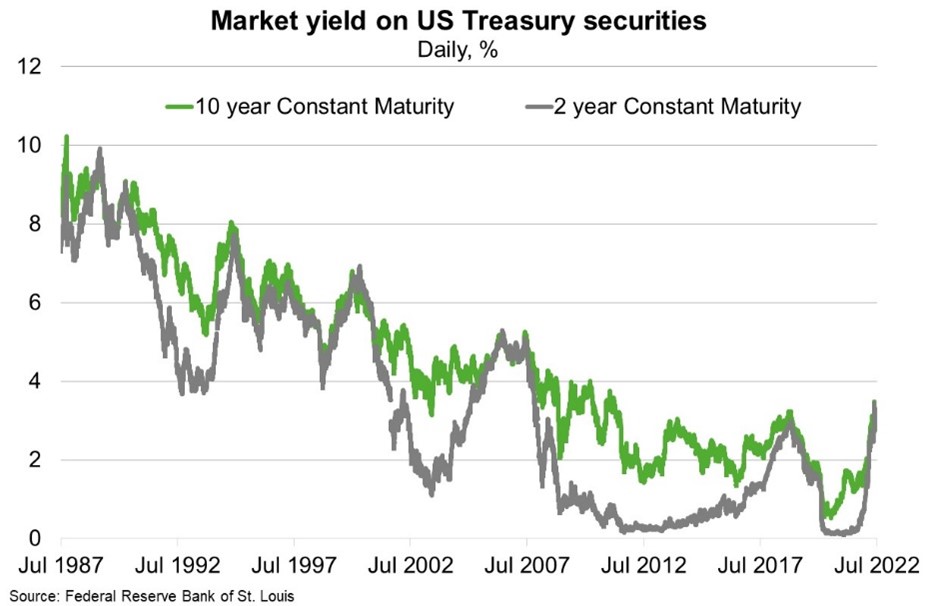

Indeed, the US Treasury yield curve inverted this month, meaning short term rates exceed long term rates. Recessions in 1990, 2001 and 2008 were preceded by inversion of the yield curve (Chart), which signals investors’ concerns about the economy and stock market. Meanwhile, the University of Michigan consumer sentiment index reached a record low in June, with consumers’ assessment of their personal financial situation down 20% from May. Sharply higher consumer prices and mortgage rates are undermining household purchasing power, and despite continued strong jobs growth, the share of the population employed is still 1.3 ppts below the February 2020 peak. US house prices appear vulnerable after soaring 38% over the two years to April. Meanwhile, small business optimism fell to its lowest level since 2013 last month. US dollar strength may also increase businesses concerns over international competitiveness, alongside domestic and global headwinds. Any US fiscal policy response to enduring weak or negative economic growth could be constrained by elevated public debt and divisive politics.