Australia—Exports find new markets amid Chinese trade disruptions

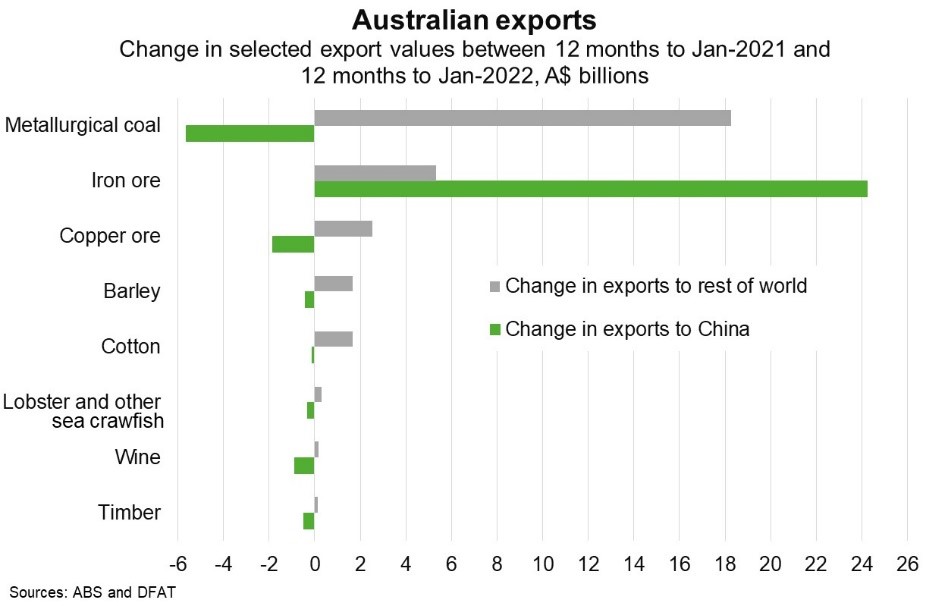

Amid trade disruptions from China over the past two years, Australian exporters have been relatively successful at finding new markets to offset lower Chinese sales. For instance, exports of coal, LNG, copper ore and some agricultural products to non-Chinese markets have increased by more than the relative decline to China (Chart). This highlights the resilience of Australian exporters to adapt to sudden and sharp shifts in market access. It also underscores the competitiveness and high-quality nature of Australian products that supports global demand. Strong farming conditions have also helped boost some agriculture exports, such as barley, while higher commodity prices have provided a further lift to export values.

Unlike bulk commodities, however, market diversification takes longer and costs more for products reliant on reputation and market presence, like wine. Australian wine exporters have suffered from sharply higher Chinese tariffs and global shipping disruptions. Two years on, there are signs of uptake in new markets; wine exports to non-Chinese markets rose about $170 million over the 12 months to January 2022 relative to the same period in 2021, led by higher sales to Singapore, Hong Kong, South Korea and Thailand. Wine exporters should benefit from greater access to the UK market once the UK free trade agreement is enacted, though the UK’s proposed new alcoholic taxation system, if implemented, poses a downside risk.

Ongoing market expansion and diversification will be important for reducing exporters’ vulnerability to further shifts in the global economic and geopolitical landscape. In this regard, the Australian government’s progress on advancing free trade agreements with fast-growing India and the United Arab Emirates, and enhancing access to Malaysia’s halal market represent three measures that can support additional opportunities for Australian exporters.