Global—High energy prices dent growth, complicate monetary policy

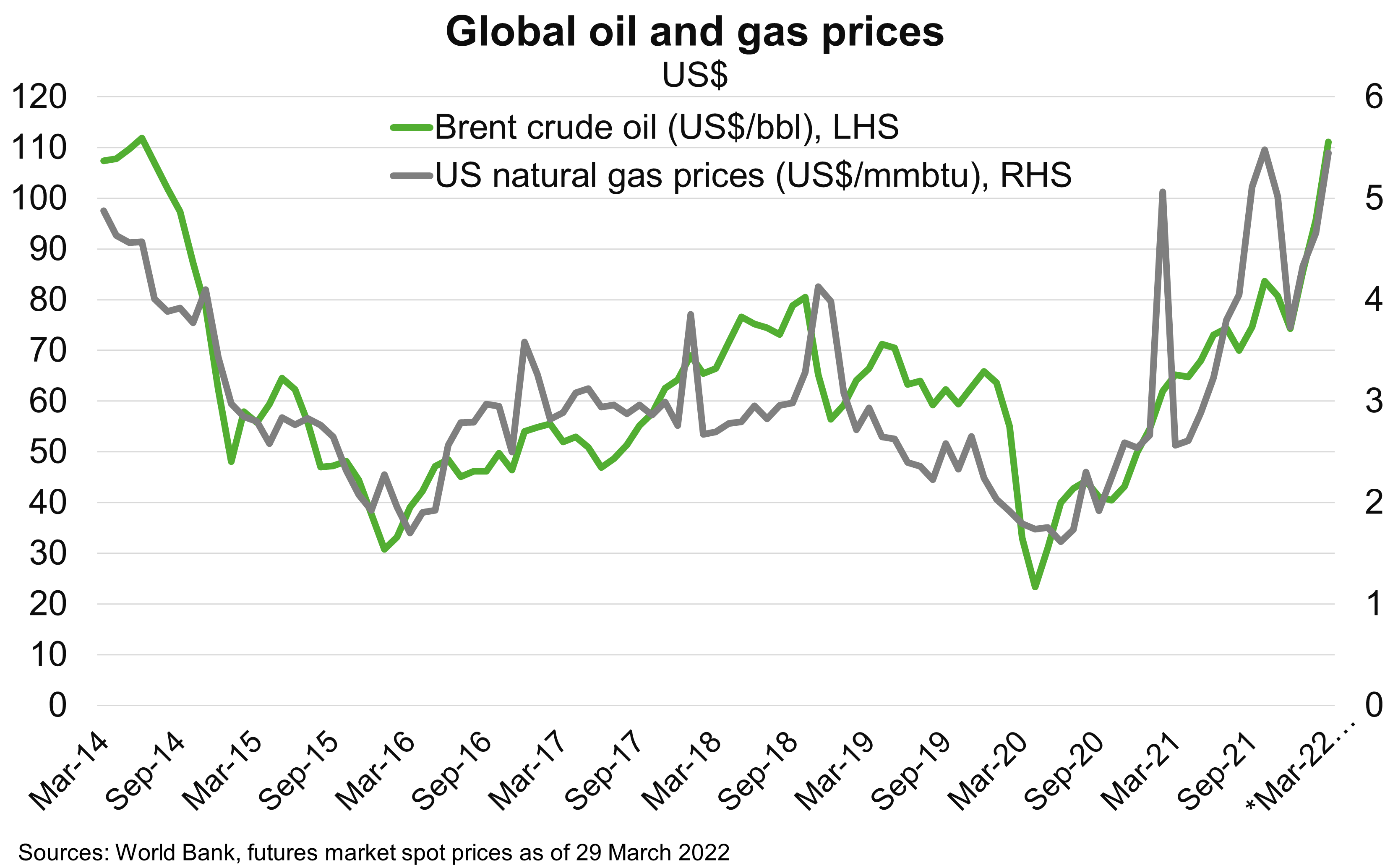

Energy prices are increasing sharply due to recovering global demand and supply disruptions, compounded by the Russia-Ukraine crisis (Chart). Russia’s important role in global energy supply means energy prices are likely to remain high. Some forecasters see oil prices at US$120 per barrel through 2022 and US$100 in 2023, compared to an average of US$70 in 2021.

Although net energy exporters, such as Saudi Arabia, Australia and Indonesia, stand to benefit, sustained high energy prices are negative overall for the global economy. That is because fossil fuels—oil, coal and natural gas—provide more than 80% of the global economy’s energy supply. Emerging markets (EMs) are particularly exposed because of their high energy intensity of production, especially South Africa, China and Thailand. Other countries, such as Chile, Turkey, Poland and the Philippines are vulnerable because of their high dependency on energy imports, where households and businesses face higher bills and reduced spending power due to costlier food, transportation and heating. Europe is particularly exposed to restrictions in Russian gas supplies, as already tight energy markets become further constrained.

Higher energy prices complicate central banks’ decisions about tightening monetary policy, given the potential for lower growth alongside higher inflation. However, the US Federal Reserve has suggested higher oil prices may induce higher interest rates. Although the US is a net oil exporter, US consumers and the economy more broadly, will therefore feel the pinch. EM central banks tend to be more sensitive to short-term inflation movements than advanced economies because inflation expectations are generally less well-anchored. Higher interest rates in EMs may be needed to curb accelerating inflation and avoid steady erosion of household purchasing power and low real returns to savings. Not doing so could stoke political and social unrest, though the prospect of more aggressive monetary tightening raises risks to domestic and global growth.