Hong Kong—COVID outbreak exacerbates economic challenges

After remaining generally very low comparatively, Hong Kong’s COVID-19 cases have surged since mid-February, exceeding 1 million total cases as of mid-March from a population of 7.4 million. Large numbers of cases are being treated in the public hospital system, impacting on the availability of health care services and hospital capacity. Increased restrictions that have accompanied the latest outbreak have suppressed consumption, prompting many forecasters to lower GDP growth projections to around 1.5% in 2022 from prior estimates of about 3%-3.5%. As cases start to decline, Hong Kong plans to ease restrictions from April 1. But the potential for sporadic tightening and loosening of mobility restrictions as cases fluctuate and precautionary behaviour from consumers and firms is likely to contribute to ongoing disruptions to consumption and services activity.

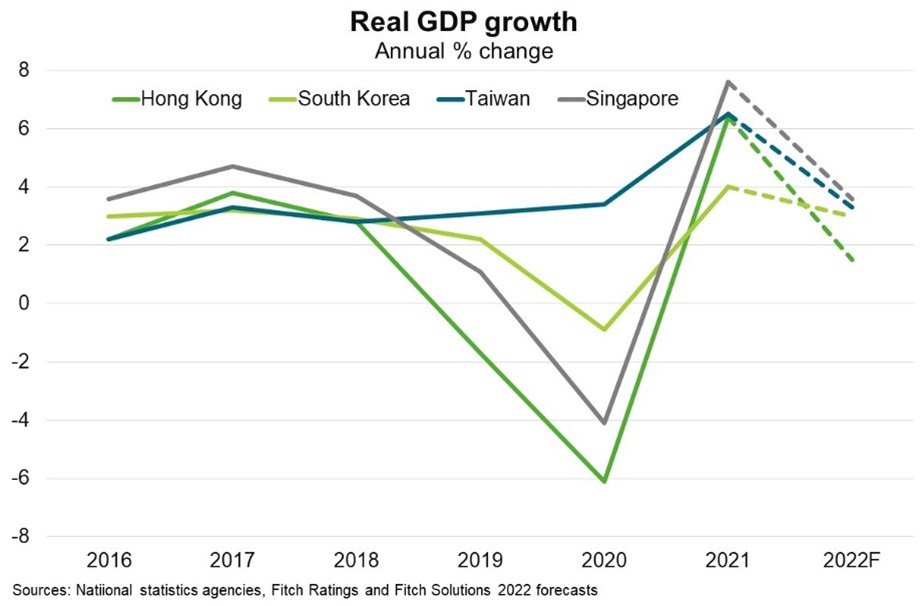

Hong Kong’s economic challenges pre-date the current COVID outbreak. The structural slowing in China’s economy (including a GDP growth target of around 5.5% in 2022) alongside lockdowns in critically important manufacturing hubs and international ports like Shenzhen and Shanghai will pressure Hong Kong’s economy. China was Hong Kong’s largest export market in 2020, accounting for 47% of domestic exports, and the second largest source of inward direct investment in 2019 (28% of total). Local developments such as COVID-19-related social distancing and border restrictions, along with implementation of the National Security Law, are causing uncertainty for business. Some foreign businesses are moving regional headquarters and certain business functions to other locations, although mainland Chinese firms continue to increase their presence in Hong Kong. Departure data shows a net outflow of people in recent years, including sharply higher departures during the current COVID-19 wave. Hong Kong’s GDP growth has lagged that of its Asian peers in recent years, a trend that is likely to continue in 2022 (Chart). Slower growth in Hong Kong (Australia’s 10th largest export market in 2020)—particularly if it is prolonged—could reduce demand for Australian exports, especially food and beverages that supply Hong Kong's retail and hospitality sectors.