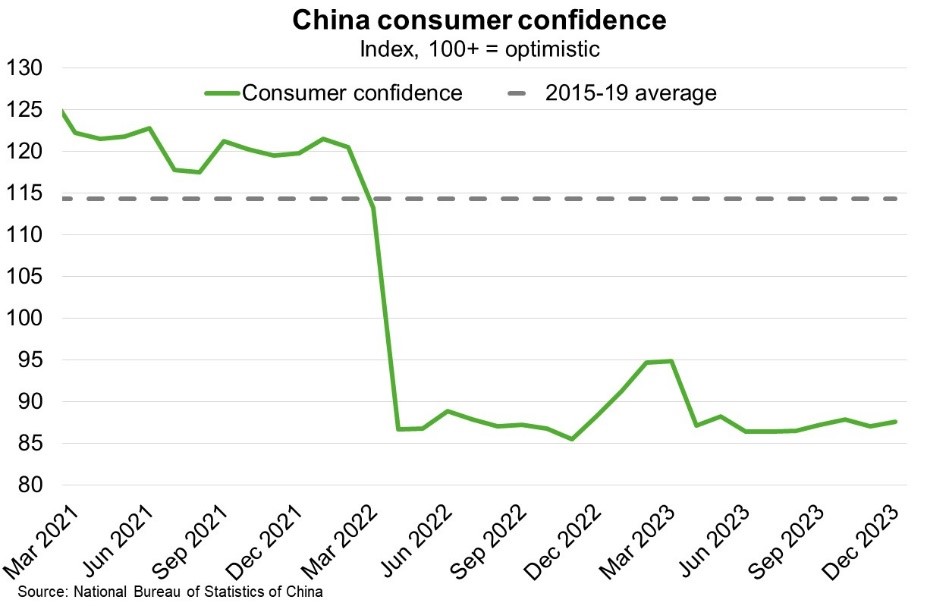

China—Stock and property market slump drags on confidence

China’s ongoing stock market decline is eroding household wealth and dragging on consumer confidence (Chart), exacerbating risks to growth in the world’s second-largest economy from a protracted property crisis and deflation. Over the past three years, about US$6 trillion has been wiped from stock exchanges in China and Hong Kong—equivalent to one-third of China’s GDP or roughly Japan and France’s combined annual economic output. China’s Shanghai Composite Index recently touched a five-year low.

Early signs suggest policy easing measures implemented in early 2024 are supporting a recovery—the Shanghai Composite has nearly pared all losses since the beginning of the year while the decline in house prices and sales are slowing. For instance, authorities have directed state-owned corporations to purchase stocks and restricted short-selling. The central bank lowered banks’ reserve ratios by 50 basis points in early February, contributing CNY1 trillion or US$140 billion of liquidity into the system to enable banks to lend more. In late February, authorities announced a 25 basis point cut in the benchmark mortgage rate, directly lowering housing borrowing costs. This builds on past measures of interest rate cuts, easing home-purchase restrictions and increased infrastructure spending, aimed at lifting consumer and investor confidence. Authorities have been reluctant to embark on large stimulus programs for fear of stoking financial instability amid high economy-wide debt levels.

China’s policy easing and the potential for new fiscal stimulus measures could provide a fillip to Australian exports this year. But downside risks are larger. Persistent weakness in consumer confidence could reduce demand for Australian goods and services ranging from agricultural products to education and tourism. Further weakness in property construction, alongside the growing threat that more Chinese property developers will default, remain risks to demand for, and prices of, Australia’s resources and energy exports.