World—‘Soft landing’ forecast in 2024 but downside risks dominate

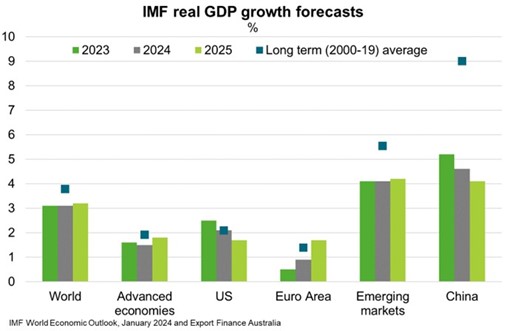

Recent global economic resilience is forecast to continue. The IMF’s January forecasts suggest global growth of 3.1% this year—the same pace as in 2023 and an upgrade from the previous October forecast of 2.9%. That said, the forecast for 2024–25 remains well below the historical (2000–19) average of 3.8% (Chart). This reflects multiple headwinds: the lagged effects of tight monetary policies; the withdrawal of fiscal support amid high debt; anaemic global trade and investment; and low productivity growth. And divergences remain across economies. Economic growth is forecast to slow in the US and China, while a recovery in the euro area is expected as lower inflation boosts real wages. Many emerging markets are also expected to accelerate—notably Brazil, India, and Southeast Asia’s major economies. Australia’s largest regional export markets will remain the world’s growth engine; Asia is on-track to deliver two-thirds to global growth in 2024, as it did in 2023.

But uncertainty is high amid conflict and geostrategic shifts, economic volatility, rapid technological change and extreme weather. This is evidenced by the range of forecasts from key economic commentators. For instance, the OECD and World Bank both forecast global growth to slow for a third consecutive year this year. In the World Economic Forum’s Global Risk Survey, just over half of the 1,500 respondents anticipated some instability and a moderate risk of global catastrophes in the next two years, while 30% expected even more turbulent conditions. Two-thirds of respondents ranked extreme weather as the top risk most likely to present a material global crisis in 2024. ‘Misinformation and disinformation’ and ‘societal polarisation’ rounded out the top three, reflecting a record electoral year and technology risks. Vigilance and diversification will remain important for Australian exporters.